It is important that your correct bank account with correct IFSC is linked to your Universal Account Number (UAN) to receive the credit of EPF funds timely.

To withdraw funds from your Employees’ Provident Fund (EPF) account it is important that your correct bank account details be recorded in the EPF account. This is necessary to ensure timely credit of the EPF funds withdrawn into your bank account. This becomes all the more important in the current scenario.

The Employees’ Provident Fund Organisation (EPFO), announced in March, 2020 that its members can withdraw money from their EPF corpus to tide over financial emergencies caused due to the coronavirus-induced lockdown.

The retirement fund body, via its Twitter handle, has asked members to provide the correct bank account details or to update their bank account details for timely credit of EPF funds at the time of withdrawal.

Here is a look at how you can check and update your bank account details in your EPF account.

What is required to make EPF withdrawal?

Saraswathi Kasturirangan, Partner, Deloitte India says, “To make a withdrawal from EPF account as allowed as per the EPF scheme rules, it is important that your active bank account with correct IFSC is linked to your Universal Account Number (UAN). If the correct bank account is not linked with the EPF account, then the credit of funds withdrawn from EPF will be delayed.”

How to check bank account details in EPF records

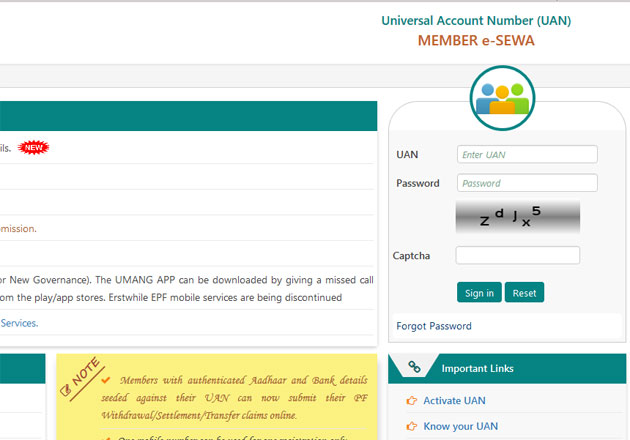

Step 1: Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and log in to your account.

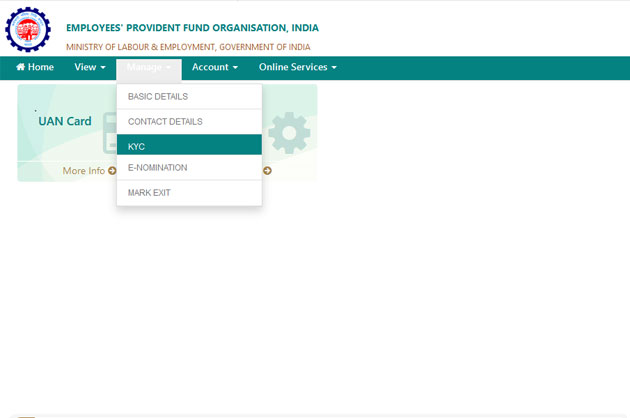

Step 2: Once logged in, click on ‘KYC option’ under the ‘Manage’ tab.

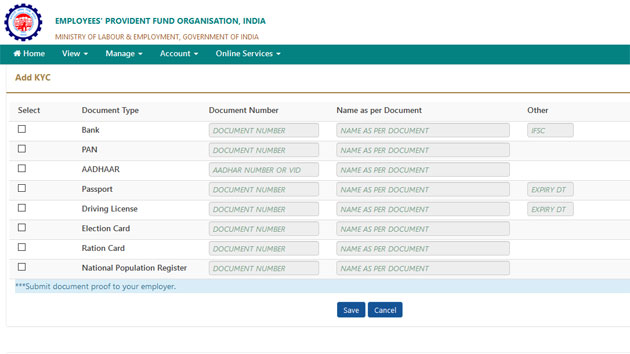

Step 3: A new webpage will appear on your screen. Under the ‘Digitally Approved KYC’, check the bank account details, i.e., the name of the bank, bank account number and IFSC.

If the bank account details are correct, then the EPF withdrawal claim will be credited into the bank account shown. If the bank account details are incorrect, then you will be required to provide the correct bank account details to receive the EPF withdrawal money.

How to update bank account details in EPF records

Step 1: Log into your account on https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Select the KYC option under the Manage Tab

Step 3: Select Document type – Bank. Add the correct bank account number where the webpage asks you to mention document number, name as per the bank records and IFSC.

Step 4: Click on ‘Save’.

Once the details are saved, the details will be shown under the ‘KYC Pending for Approval’ tab.

Remember, the bank account details must be approved by your employer to be updated in EPFO’s records. To hasten the process, the employee should ask his/her employer to approve the change of bank account details in the EPFO’s records.

Kasturirangan says, “Once the employer has approved the change, it usually takes about a week for the change to be reflected in EPFO records.”

Point to remember

To access your account on the EPFO’s Member e-Sewa portal, your UAN must be active. Click here to know how to activate your UAN.