The Universal Account Number or UAN is a 12-digit unique number assigned to every employee contributing to the EPF. It is generated and alloted by the Employee Provident Fund Organisation (EPFO) and authenticated by the Ministry of Labour and Employment, Government of India. The UAN of an employee remains the same throughout his life irrespective of the number of jobs he/she changes.

Every time an employee switches his/her job, EPFO allots a new member identification number or EPF Account (ID), which is linked to the UAN. As an employee, one can put in a request for a new member ID by submitting the UAN to the new employer. Once the member ID is created, it gets linked to the UAN of the employee. Hence, the UAN will act as an umbrella for the multiple Member Ids allotted to the employee by different employers.

The UAN remains same and portable throughout the life of an employee. The employee shall have a different member ID when switching between jobs. All such member IDs are linked to the employee’s UAN to ease the process of EPF transfers and withdrawals.

How to know your UAN

a. Through Employer

Generally, you are allotted a Universal Account Number by your employer as per the EPFO. Some employers print the UAN number in the salary slips too.

b. Through UAN Portal using PF number/member ID

If you are unable to get your Universal Account Number from the employer, you can obtain it through the UAN portal also. You need to follow the steps below:

Step 1: Go the UAN Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Click on the tab ‘Know your UAN Status’. The following page will appear.

Step 3: Select your state and EPFO office from the dropdown menu and enter your PF number/member ID along with the other details such as name, date of birth, mobile no, and captcha code. You can get the PF number/member ID from your salary slip. Enter the tab ‘Get Authorization Pin’.

Step 4: You will receive a PIN on your mobile number. Enter the PIN and click on the ‘Validate OTP and get UAN’ button.

Step 5: Your Universal Account Number will be sent to your mobile number.

How to activate and login to the EPFO website using UAN?

To activate UAN, you must have your Universal Account Number and PF member ID with you.

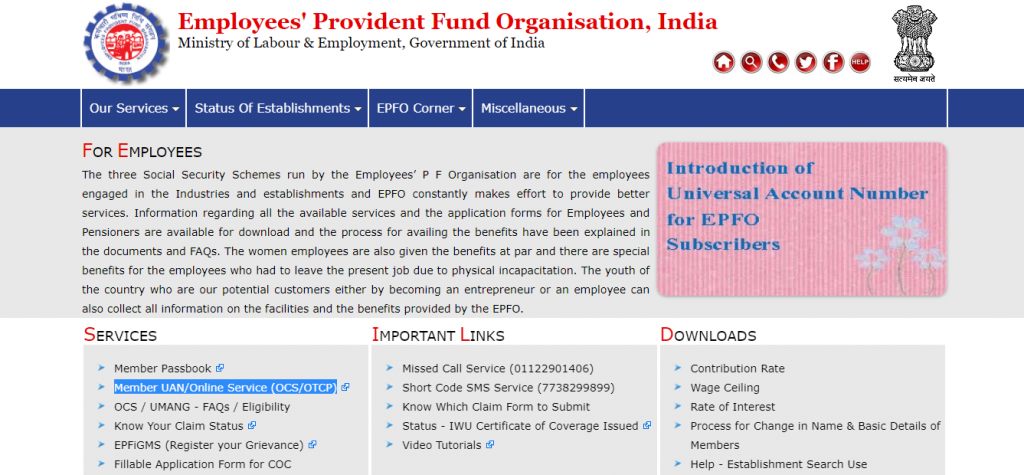

Given below are the steps to activate UAN on the EPFO portal:Step 1: Go to the EPFO homepage and click on ‘For Employees’ under ‘Our Services’ on the dashboard.

Step 2: Click on ‘Member UAN/Online services’ in the services section. You will reach the UAN portal.

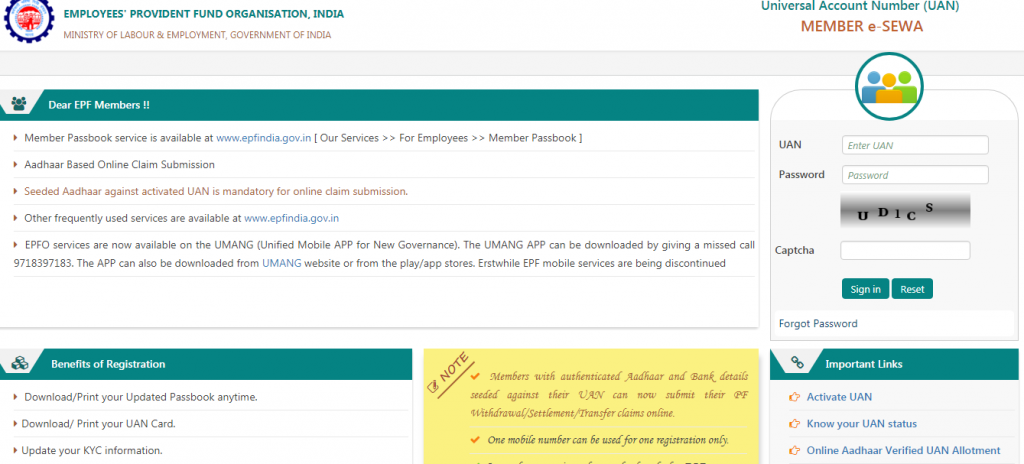

Step 3:

- Enter your Universal Account Number, mobile number and PF member ID. Enter the captcha characters. Click on the ‘Get authorization PIN’ button. You will receive the PIN on your registered mobile number.

- Click on ‘I Agree’ under the disclaimer checkbox and enter the OTP that you receive on your mobile number and click on ‘Validate OTP and Activate UAN’.

- On UAN activation, you will receive a password on your registered mobile number to access your account.

Features & benefits of UAN

- The UAN helps to centralise employee data in the country.

- One of the most significant uses of this unique number is that it brings down the burden of employee verification from companies and employers by EPF organisation.

- This account made it possible for EPFO to extract the bank account details and KYC of the member and KYC without the help of the employers.

- It is useful for EPFO to track multiple job switches of the employee.

- Untimely and early EPF withdrawals have reduced considerably with the introduction of UAN

Advantages of UAN to employees

- Every new PF account with a new job will come under the umbrella of a single unified account.

- It is easier to withdraw (fully or partially) PF online with this number.

- The employees themselves can transfer PF balance from old to new using this unique account number.

- Any time you want a PF statement (visa purpose, loan security, etc.), you can download one instantly – either by logging in using the member ID or UAN or by sending an SMS.

- There is no need for new employers to validate your profile if the UAN is already Aadhaar and KYC-verified.

- UAN ensures that employers cannot access or withhold the PF money of their employees.

- It is easier for employees to ensure that his/her employer is regularly depositing their contribution in the PF account.

Documents required to open UAN

If you have just joined your first registered company for a job, you need the following documents to get your Unique Account Number.

- Bank account info: Account number, IFSC code, and branch name.

- ID proof: Any photo-affixed and national identity cards like driving license, passport, voter ID, Aadhaar, and SSLC Book

- Address proof: A recent utility bill in your name, rental/lease agreement, ration card or any of the ID proof mentioned above if it has your current address.

- PAN card: Your PAN should be linked to the UAN.

- Aadhaar card: Since Aadhaar is linked to the bank account and mobile number, it is mandatory. .

- ESIC card