How to compute your monthly SSS contribution.

The amount that members remit to the SSS depends on two factors:

- Membership type – Employed, kasambahay, self-employed, voluntary, non-working spouse, and OFW members have different contribution amounts. Contributions of employees, kasambahays, and certain OFWs are deducted from their monthly salary and remitted to the SSS (along with the employer’s share of contribution) by their respective employers. Others have to pay their entire contribution.

- Monthly salary credit (MSC) – The Social Security Law defines the MSC as “the compensation base for contributions and benefits“1. The SSS uses the MSC to compute the required contribution for members based on their monthly income. The higher your monthly earnings, the higher your MSC is. The higher your MSC, the higher your contribution becomes. On the SSS contribution table, you’ll find the MSC that corresponds to your income range.

The new SSS Contribution Schedule.

Before you begin computing your contribution, understand first the key changes to the SSS Contribution Schedule following the Social Security Act of 2018 implementation.

Starting in April 2019, the contribution rate has increased from 11% to 12% of the MSC and will continue to rise by 1% every other year until it reaches 15% by 2025.

The new law has also increased the maximum MSC from Php 16,000 to Php 20,000.

What do these changes mean? Obviously, you’re paying a higher monthly contribution now. But this will also increase your SSS benefits since they’re computed based on a higher MSC.

Ultimately, the SSS contribution hike will extend the SSS fund life, which raises your chance of receiving retirement benefits in the future.

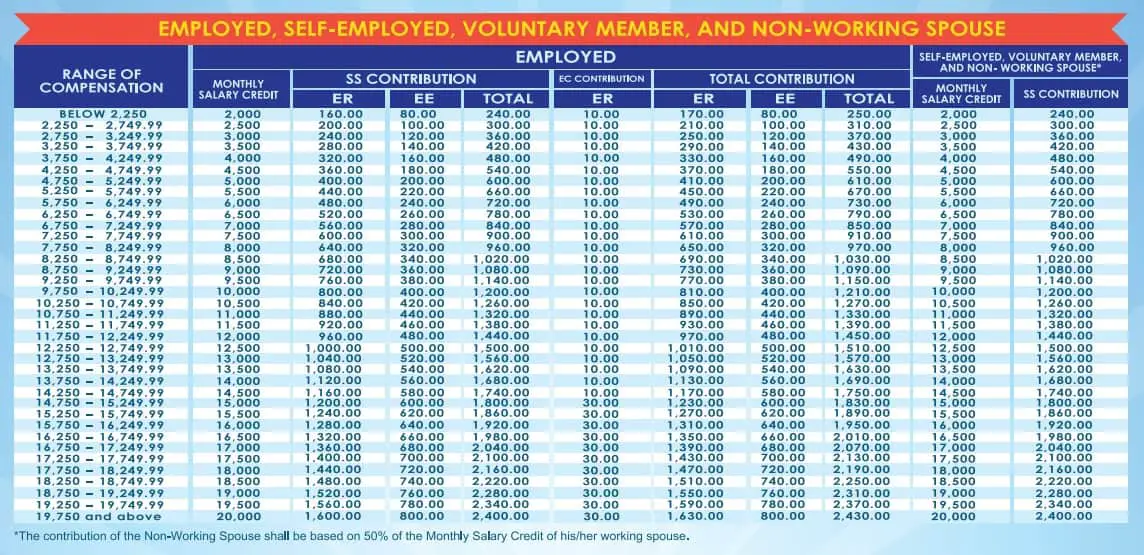

Table 1: SSS Contributions of Employed, Self-Employed, Voluntary Member, and Non-Working Spouse.

(Note: The SSS contribution table above and the succeeding ones can be used only from April 2019 to the end of 2020, as the contribution rate will increase again in 2021 onwards.)

a. How much should employees and employers contribute?

Of the 12% contribution rate, the employee pays 4% through monthly salary deductions, while the employer shoulders the remaining 8%.

Additionally, employers pay the monthly contribution for the Employees’ Compensation (EC) Program, which is Php 10 per employee earning below Php 14,750 or Php 30 per employee earning Php 14,750 and above).

Employers are required to remit all those contributions to the SSS on time.

For employers and employees, here’s how to determine the monthly contribution using the SSS contribution table:

1. On the leftmost column (“Range of Compensation”), find the salary bracket where the current monthly income falls and its corresponding MSC on the Monthly Salary Credit column. For example, employees earning Php 19,750 and above have an MSC of Php 20,000.

2a. If you’re an employer: Find your share of contribution for a particular employee on the ER column corresponding to the employee’s MSC. Per employee with an MSC of Php 20,000, you must pay Php 1,600 for the SSS contribution plus Php 30 for the EC contribution. The total amount to pay out of the pocket is Php 1,630.

2b. If you’re an employee: Find your monthly deduction for SSS contribution on the EE column corresponding to your MSC. If your MSC is Php 20,000, your employer should deduct Php 800 from your monthly salary.

3. To know the total monthly contribution, look for the amount on the rightmost column under “Total Contribution.” For an employee with an MSC of Php 20,000, the total monthly contribution is Php 2,430 (Php 800 employee’s share + Php 1,600 employer’s share + Php 30 EC contribution). This is the amount the employer must remit to the SSS, which is posted on the employee’s SSS account after payment.

Another way to compute the monthly contribution is to use this formula: MSC x Contribution Rate.

Again, let’s use the maximum MSC of Php 20,000 as an example.

Employee’s share: Php 20,000 x 0.04 (4% contribution rate) = Php 800

Employer’s share: Php 20,000 x 0.08 (8% contribution rate) = Php 1,600 (plus Php 30 for the EC contribution)

Total contribution: Php 800 + Php 1,600 + Php 30 = Php 2,430

b. How much should self-employed members contribute?

If you’re currently registered as self-employed, the monthly earnings you declared on your Form E-1 or the latest Form E-4 will be the basis for your MSC and monthly contribution.

Using the SSS contribution table (Table 1) above, here are the steps to figure out how much your monthly contribution is.

1. On the leftmost column (“Range of Compensation”), find the range where your declared monthly income falls.

2. Under “Self-Employed, Voluntary Member, and Non-Working Spouse,” find your corresponding MSC on the “Monthly Salary Credit” column. For example, if your declared income is in the range of Php 19,750 and above, your MSC is Php 20,000.

3. Next to your MSC, find your contribution amount on the “SS Contribution” column. With an MSC of Php 20,000, your monthly contribution is Php 2,400.

Or use this formula:

MSC x Contribution Rate = Monthly Contribution Amount

Let’s say your MSC is Php 20,000 and the contribution rate is 12% (for 2019 to 2020), here’s how to compute your contribution as a self-employed member:

Php 20,000 x 0.12 = Php 2,400

c. How much should voluntary members contribute?

It’s tricky to determine the SSS contribution of voluntary members because their income is not fixed.

As such, the SSS only requires people who are paying their first contribution as a voluntary member to choose any MSC from the contribution table, regardless of their last posted MSC (as a former employed/self-employed/OFW member).

Your choice of MSC as a voluntary paying member depends on how much you receive on a certain month. Practically speaking, you can pay only what you can afford per month.

Here’s how to determine your monthly contribution as a voluntary member using the contribution table:

1. Under “Self-Employed, Voluntary Member, and Non-Working Spouse,” select your preferred MSC on the “Monthly Salary Credit” column.

2. Take note of the amount next to your chosen MSC (on the “SS Contribution” column). For example, if you choose Php 5,000 as your MSC, your monthly contribution is Php 600.

d. How much should a non-working spouse contribute?

A non-working spouse’s monthly contribution is based on 50% of his/her working spouse’s MSC.

Use Table 1 above to find out your monthly contribution as a non-working spouse. Here’s how:

1. Determine your spouse’s MSC. On the leftmost column (“Range of Compensation”), find your spouse’s salary bracket. For example, if your husband’s income is in the range of Php 19,750 and above, his MSC is Php 20,000.

2. Divide your spouse’s MSC by half. If your husband’s MSC is Php 20,000, half of it is Php 10,000.

3. Under “Self-Employed, Voluntary Member, and Non-Working Spouse,” find your spouse’s 50% MSC on the “Monthly Salary Credit” column.

4. Take note of the amount next to your spouse’s 50% MSC (on the “SS Contribution” column). If 50% of your spouse’s MSC is Php 10,000, your monthly contribution is Php 1,200.

If 50% of your spouse’s MSC doesn’t correspond to any MSC in the SSS contribution table, base your contribution on the next higher MSC.

For example, if your spouse earns Php 3,500 per month, 50% of his/her MSC (Php 3,500) is Php 1,750 (which is below the minimum MSC of Php 2,000). The next higher MSC is Php 2,000. Therefore, your monthly contribution is Php 240.

Table 2: OFW Members.

a. How much should OFWs contribute?

The following OFWs share SSS contribution with their employers:

- Sea-based OFWs

- Land-based OFWs in countries where the Philippines has bilateral labor agreements:

- Austria

- Belgium

- Canada

- Denmark

- France

- Germany

- Japan

- Netherlands

- Portugal

- Spain

- Switzerland

- The U.K. and Northern Ireland

These OFWs pay 4% of their MSC, while employers contribute 8% of their worker’s MSC plus the monthly EC contribution of Php 10 per OFW earning below Php 14,750 or Php 30 per OFW earning Php 14,750 and above.

Under the Social Security Act of 2018, manning agencies are considered employers of sea-based OFWs. Thus, manning agencies should collect and remit sea-based OFWs’ contributions to the SSS.

On the other hand, land-based OFWs in countries without bilateral labor agreements should pay the full contribution on their own.

Here are the steps to compute OFW monthly contribution using the SSS contribution table:

i. For sea-based OFWs and land-based OFWs with a bilateral labor agreement.

1. On the leftmost column (“Range of Compensation”), find your salary bracket and its corresponding MSC on the Monthly Salary Credit column. For example, if you’re earning Php 19,750 or higher, your MSC is Php 20,000.

2. Find your employer’s share of contribution in the ER column corresponding to your MSC. If your MSC is Php 20,000, your employer’s share is Php 1,600 plus the Php 30 EC contribution for a total of Php 1,630.

3. Find your share of contribution in the EE column corresponding to your MSC. Taking the example above (MSC of Php 20,000), your employee’s share is Php 800.

4. Under “Total Contribution,” find your total monthly contribution on the rightmost column. If your MSC is Php 20,000, your total monthly contribution is Php 2,430 (Php 800 employee’s share + Php 1,600 employer’s share + Php 30 EC contribution). This is the total amount your employer must remit to the SSS, which is posted on your SSS account after payment.

Another way to compute the monthly contribution is to use this formula: MSC x Contribution Rate.

Again, let’s use the maximum MSC of Php 20,000 as an example.

Employee’s share: Php 20,000 x 0.04 (4% contribution rate) = Php 800

Employer’s share: Php 20,000 x 0.08 (8% contribution rate) = Php 1,600 (plus Php 30 for the EC contribution)

Total contribution: Php 800 + Php 1,600 + Php 30 = Php 2,430

ii. For land-based OFWs without a bilateral labor agreement.

1. On the leftmost column (“Range of Compensation”), find your salary bracket.

2. Under “Land-Based OFWs Without Bilateral Labor Agreement,” find your corresponding MSC on the “Monthly Salary Credit” column. For example, if your income is in the range of Php 19,750 and above, your MSC is Php 20,000.

3. Next to your MSC, find your contribution amount on the “SS Contribution” column. With an MSC of Php 20,000, your monthly contribution is Php 2,400.

Or use this formula:

MSC x Contribution Rate = Monthly Contribution Amount

Let’s say your MSC is Php 20,000 and the contribution rate is 12% (for 2019 to 2020). Here’s how to compute your full contribution:

Php 20,000 x 0.12 = Php 2,400

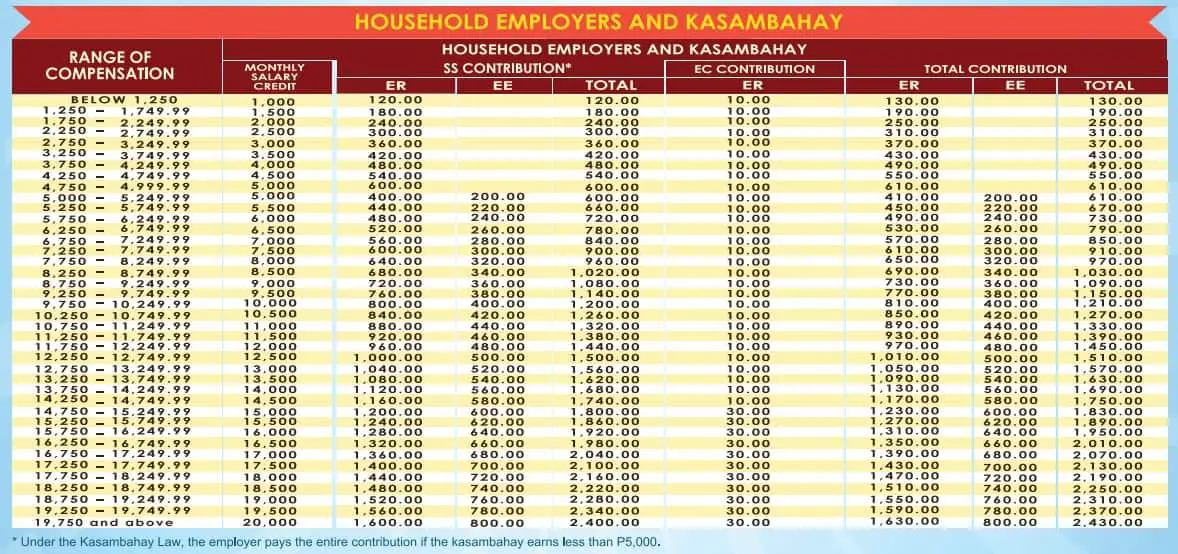

Table 3: Household Employers and Kasambahay.

a. How much should household employers and kasambahays contribute?

For house helpers with a monthly salary below Php 5,000, the Kasambahay Law requires household employers to pay the full monthly contribution.

However, kasambahays who receive Php 5,000 or higher have to share in their contribution payment (4% of their MSC), while their employer pays 8% of the MSC plus the EC contribution of Php 10 per worker earning below Php 14,750 or Php 30 per worker earning Php 14,750 and above.

Using the SSS contribution table for household employers and kasambahay, here’s how to compute your monthly contribution:

1. On the leftmost column (“Range of Compensation”), find the range where the current monthly income falls and its corresponding MSC on the Monthly Salary Credit column. For example, if the kasambahay‘s monthly salary is Php 3,500 (the current minimum wage in Metro Manila), his/her MSC is Php 3,500.

2a. If you’re a household employer: Find your share of contribution on the ER column corresponding to your kasambahay‘s MSC. Using the example above (MSC of Php 3,500), you must pay Php 420 for the SSS contribution plus Php 10 EC contribution for a total of Php 430.

2b. If you’re a kasambahay: Find your monthly deduction for SSS contribution on the EE column corresponding to your MSC. Taking the example above (MSC of Php 3,500), there should be no salary deduction for SSS contribution since your employer shoulders your entire contribution. But if you’re earning Php 5,000 monthly, for example, your employer should deduct Php 200 from your salary and remit it to the SSS along with your employer’s share.

3. To know the total monthly contribution, look for the amount on the rightmost column under “Total Contribution.” For example, if a kasambahay has an MSC of Php 5,000, the total monthly contribution is Php 610 (Php 200 employee’s share + Php 400 employer’s share + Php 10 EC contribution). This is the amount the employer must remit to the SSS, which is posted on the kasambahay‘s SSS account after payment.

Another way to compute the monthly contribution is to use this formula: MSC x Contribution Rate.

Again, let’s use the maximum MSC of Php 5,000 as an example.

Employee’s share: Php 5,000 x 0.04 (4% contribution rate) = Php 200

Employer’s share: Php 5,000 x 0.08 (8% contribution rate) = Php 400 (plus Php 10 for the EC contribution)

Total contribution: Php 200 + Php 400 + Php 10 = Php 610