Homepage content on www.gst.gov.in

Once you log into the www.gst.gov.in (GST Portal)you can see the below listed content on the homepage:

1. Dashboard

When you log into the GST Portal gst.gov.in, a dashboard will appear. The taxpayer can create challan, file GST Returns and view notices on this dashboard.

2. Services

After logging into the GST Portal www.gst.gov.in, the taxpayer get a list of different services that are available on it

Registration Tab

Ledgers Tab

Returns Tab

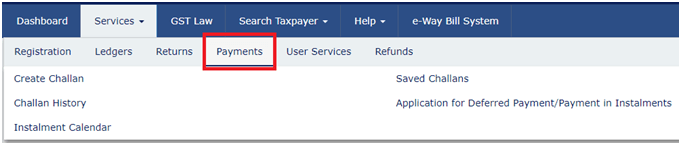

Payments Tab

User Services

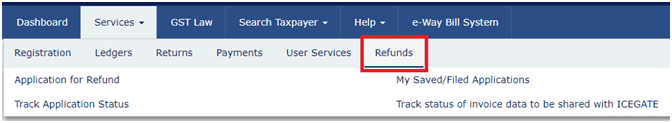

Refunds Tab

3. Search Taxpayer

Using this feature you can easily search for taxpayer either by their GSTIN or PAN. This helps in cross verification of the taxpayer’s identity. On the search taxpayer menu the user can search composition taxpayer too.

Note: You can use this feature without logging on the GST Portal (gst.gov.in)

4. Help

The help section on the GST Portal consists of several guides/user manuals, videos, FAQs along with systems requirements for various GST process. This section on the GST portal resolves any queries of a taxpayer related to the GST.

5. E-way bill system

E-way Bill section on the GST Portal redirects you to the https://ewaybill.nic.in/. Moreover in this section you can read about uses of e-way bill, mode of generation, validity and content of e-way bill.

6. New Return Prototype

New Return Prototype on the GST Portal helps the taxpayer to get familiar with the New GST Returns. This redirects you to the https://demoofflinetool.gst.gov.in/instructions where in you need to login. After logging in a home page will appear.

List of Services on the GST Portal (gst.gov.in login)

Here is the list of Services on the GST Portal (gst.gov.in login):

- Normal Taxpayer, ISD, Casual Dealer Registration application

- GST Practitioner Application

- GST CMP-02 Form to opt composition scheme

- GST CMP-03 Form for Composition Dealers to intimate stock intimation

- GST CMP-04 Form to opt out of composition scheme